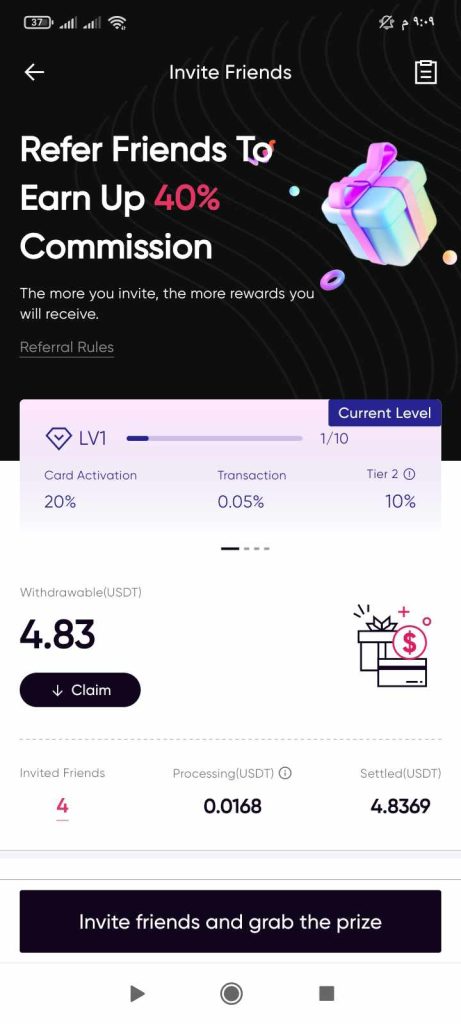

As digital currencies become increasingly popular worldwide, the need for convenient, secure ways to integrate these currencies into everyday life has become more essential. The RedotPay card is a pioneering digital currency solution designed to help users spend their cryptocurrencies seamlessly and efficiently. In this article, we’ll explore the features of the RedotPay card and guide you through using their official website.

What is the RedotPay Digital Currency Card?

The RedotPay card is a prepaid card specially designed for users looking to easily spend their digital currencies. It allows users to convert cryptocurrencies into traditional currencies and use them in everyday transactions, both in physical stores and online. The card is issued in collaboration with recognized financial institutions, ensuring secure and reliable transactions.

Key Features of RedotPay

- Ease of Use

The RedotPay card enables effortless transactions wherever traditional credit cards are accepted, making it ideal for daily spending. - Security

RedotPay uses advanced security protocols, including data encryption and protection, to provide users with an additional layer of financial security. - Flexibility

Supporting a wide range of digital currencies, the card offers users the freedom to select their preferred currency, adding significant flexibility in managing digital assets. - Convenience

Users can manage their cards and funds through the RedotPay mobile app or website, making it easy to track and control finances on the go.

Using the RedotPay Website

RedotPay’s official website offers a user-friendly interface for managing digital currency cards. Here’s how to get started:

- Registering & Creating an Account

Visit the website to sign up and create an account. The registration process involves basic information entry and identity verification for secure account access. - Card Management

The website allows users full control of their cards, including activation, balance review, and transaction tracking. Users can also reload their cards with both digital and traditional currencies. - Currency Conversion

RedotPay provides an option to convert digital currencies to traditional ones, enabling users to maximize their digital assets conveniently through the site’s dashboard. - Customer Support

The website includes comprehensive technical support, offering assistance through email and live chat to resolve issues or answer queries. - Mobile App

In addition to the website, RedotPay offers a mobile app that lets users manage their cards and funds from anywhere at any time.

RedotPay Card Fees

RedotPay’s official website has up-to-date details on fees associated with the card. Here’s an overview of common fees associated with digital currency cards like RedotPay:

- Issuance Fee: Covers the cost of card issuance. This can range from free to a nominal fee based on card type and service level.

- Shipping Fees: If the card is shipped to your address, there may be shipping fees, especially if you reside outside of the company’s free-shipping areas.

- Monthly or Annual Maintenance Fees: Some cards may require a monthly or annual maintenance fee, covering administrative services.

- Transaction Fees: This includes charges for each transaction, whether local or international, and may vary depending on the currency used.

- Conversion Fees: Fees may apply for converting digital currencies to traditional ones and vice versa, depending on the currencies and conversion value.

- Reload Fees: Reloading the card with digital or traditional currency might incur a service fee.

To view specific details on RedotPay fees, visit their official fees page at RedotPay.

How to Order a RedotPay Card

Ordering a RedotPay card is straightforward and can be completed in a few steps through the official website. Here’s a step-by-step guide:

- Visit the Official Website

Start by visiting RedotPay’s official website at RedotPay. - Create a New Account

If you don’t already have an account, register by clicking “Sign Up” or “Create New Account,” entering your email and password, and following the prompts to verify your email. - Log In

Once your account is confirmed, log in with your credentials. - Navigate to the Cards Section

After logging in, find the “Cards” section or “Request New Card” option in your dashboard. - Choose Your Card Type

Select the type of RedotPay card you wish to order. Different card types may be available depending on your needs. - Enter Required Information

You’ll need to provide personal and financial information, including your full name, email, mailing address, and identification (e.g., ID number or passport). - Pay Any Required Fees

Issuance or shipping fees may apply. Complete payment through the methods available on the site. - Confirm Order

Review the information provided and confirm your request by clicking “Confirm” or “Submit Request.” - Await Approval

After submitting your request, RedotPay will review the information provided. Approval may take a few business days, and you’ll receive a notification via email or your account once the request is approved. - Receive Your Card

Upon approval, your card will be shipped to the address you provided. Delivery times vary based on your location. - Activate the Card

Once your card arrives, follow the instructions provided to activate it through the RedotPay website or mobile app.

Linking Your RedotPay Card to Apple Pay

Adding your RedotPay card to Apple Pay allows for seamless payments through your iPhone or other Apple devices. Follow these steps to link your card:

- Confirm Compatibility

Check if your RedotPay card is compatible with Apple Pay via the official RedotPay website or customer support. - Open the Wallet App on Your iPhone

Open the “Wallet” app on your iPhone. If using an iPad, go to “Settings” and select “Wallet & Apple Pay.” - Add a New Card

Tap the “+” icon in the upper right to add a new card, then choose “Add Credit or Debit Card.” - Scan or Enter Card Details

Use your iPhone’s camera to scan your RedotPay card or manually enter the required information. - Verify the Card

Complete verification by entering a code sent to your email or phone associated with the card. Follow the on-screen prompts to finalize verification. - Activate for Use in Apple Pay

Once verified, your card is ready for use in Apple Pay. You may need to agree to Apple Pay’s terms and conditions. - Set as Default (Optional)

To make RedotPay your default payment method, go to “Wallet & Apple Pay” settings and set it as the primary card.

Using RedotPay Card with Apple Pay

Once linked, your RedotPay card can be used for payments as follows:

- In Stores: Open the Wallet app, select RedotPay, then hold your iPhone near the payment terminal, using either Touch ID or Face ID to confirm.

- In Apps and on the Web: Select Apple Pay at checkout and choose RedotPay to complete the transaction.

Conclusion

The RedotPay digital currency card provides an innovative and secure solution for users wishing to integrate digital currency usage into their everyday transactions. With advanced features and ease of use, RedotPay is an ideal choice for diverse financial needs. The website offers a simple and secure interface for card and funds management, enhancing the user experience and making cryptocurrency transactions more accessible and flexible. For more information and to get started with RedotPay, visit their official site at RedotPay.